As consumers face higher costs for nearly everything they buy, there have been reports of shoppers trading down to cheaper brands in different food and beverage categories, including beer. But not all beer makers are seeing a wholesale switch to economy brands.

Breweries have already been facing higher costs for raw materials like aluminum and barley as a result of inflation. Craft breweries across America have been on the front lines of businesses facing higher material costs because of inflation. Now, many are confronting a shortage of a key ingredient: carbon dioxide, the gas that gives beer its crisp, effervescent taste. And one brewer has already said it plans to shut down a key manufacturing plant and lay off workers as a result.

WISEACRE Brewing Company today announces its plans to launch statewide distribution throughout Texas in August 2022. Thanks to a new distribution partnership with Austin-based Dynamo Distributing, three of WISEACRE’s year-round beers, Bow Echo Hazy IPA, Gotta Get Up to Get Down Coffee Milk Stout, and the Great American Beer Festival Bronze Medal-winning Tiny Bomb Pilsner, as well as a rotating seasonal beer lineup (which currently features Oktoberfest), will be available at throughout Texas, including close to 200 H-E-B locations in the four major metro areas of the state.

Royal Unibrew will acquire Toronto-based company Amsterdam Brewery Co. Ltd. for $44m CAD ($34m USD); helping boost production in North America.

On July 13, the top story on The New York Times’ homepage wasn’t about the war in Ukraine, the January 6 Committee hearings, or President Biden’s diplomatic trip to the Middle East. It’s about inflation, which rose to 9.1% in June, its highest rate since 1981.

Fresh off the heels of opening a new distribution center, Hi-Wire Brewing has unveiled 2022 expansion plans for its Biltmore Village Production Brewery and South Slope Specialty Brewery, both located in Asheville, N.C., in addition to the opening of three new taprooms in the same year.

Each year, craft breweries across the nation roll out new limited release beers to entice beer drinkers through the seasons but few can tantalize fans with rebrews of recipes tried, true and back only by popular demand. Stone Brewing announces its line-up of Stone Fan Favorites, voted on by loyal fans of Stone’s prolific 25-year brewing history.

The National Beer Wholesalers Association (NBWA) recently released the Beer Purchasers’ Index (BPI) for December 2021. This December’s total index reading of 71 is the highest ever recorded for a December survey. Continued supply chain challenges combined with planned/expected price increases in 2022 are driving higher index readings as distributors and retailers seek to build their inventories heading into the new year.

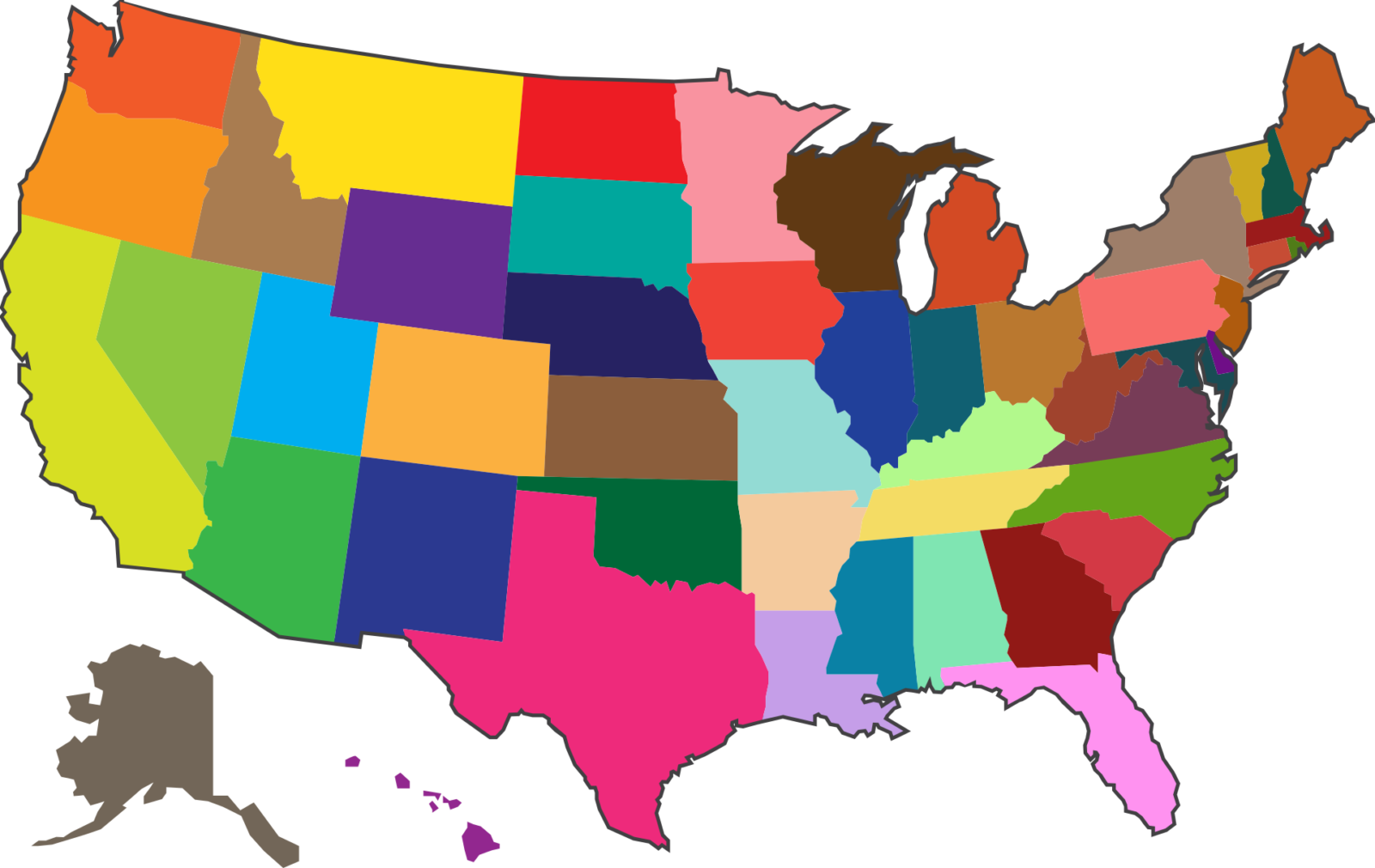

The current state of affairs for shipping beer direct to consumers (DTC) is not that great. Breweries in the United States can only ship to nine states plus the District of Columbia, which equates to only 17% of the U.S. population. For comparison, U.S. wineries can ship to 47 states and 97% of the U.S. population. Beer DTC is still in a state of infancy, but the good news for breweries is there’s a tremendous amount of untapped opportunity.